Discover the very best Wyoming Credit Unions: Your Overview to Local Financial Solutions

Discover the very best Wyoming Credit Unions: Your Overview to Local Financial Solutions

Blog Article

Discover the Advantages of Lending Institution Today

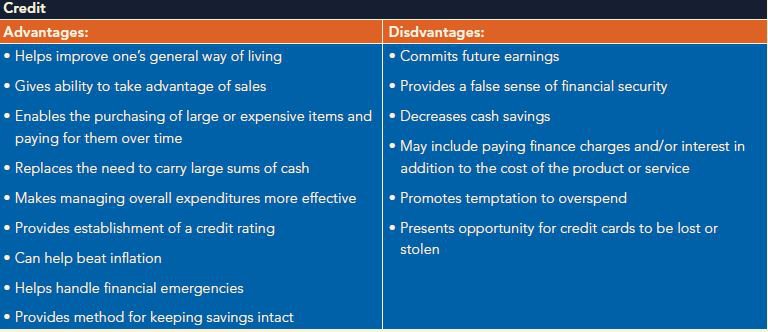

Credit unions stand apart for their one-of-a-kind method to economic services, supplying a distinct set of advantages that accommodate their participants' demands in a manner that traditional financial institutions commonly struggle to match. From customized customer support to affordable rates of interest and a community-focused strategy, lending institution supply an engaging option for people looking for even more than simply the typical banking experience. By checking out the advantages of credit unions even more, one can find a banks that prioritizes its participants' financial wellness and aims to develop lasting connections based on depend on and support.

Membership Benefits

Subscription benefits at credit rating unions incorporate a range of economic advantages and services customized to foster participant prosperity and health - Credit Union Cheyenne. One substantial benefit of debt union subscription is the personalized client solution that participants obtain.

Furthermore, credit report unions often provide access to lower rate of interest rates on loans, greater rates of interest on interest-bearing accounts, and lowered costs contrasted to larger monetary establishments. Participants can make the most of these positive prices to save cash on lendings or grow their financial savings much more effectively. Furthermore, credit report unions frequently supply a selection of financial product or services, such as charge card, home loans, and pension, all made to meet the varied demands of their participants.

Lower Fees and Better Rates

Cooperative credit union stick out for their commitment to supplying lower charges and better rates, lining up with their mission to offer participants financial benefits that standard financial institutions may not focus on. Unlike banks that aim to take full advantage of revenues for investors, credit scores unions are not-for-profit companies owned by their members. This structure allows lending institution to concentrate on serving their participants' benefits, causing reduced fees for services such as inspecting accounts, financings, and credit score cards. Additionally, cooperative credit union usually supply more affordable rate of interest on interest-bearing accounts and loans compared to traditional banks. By keeping fees low and rates competitive, debt unions help participants conserve money and accomplish their financial goals much more successfully. Members can profit from lowered prices on important financial solutions while making higher returns on their deposits, making credit unions a preferred selection for those looking for beneficial and cost-effective monetary remedies.

Area Participation and Support

Active neighborhood involvement and support are essential facets of lending institution' operations, showcasing their dedication to cultivating regional connections and making a favorable influence beyond financial solutions. Unlike standard financial institutions, credit score unions focus on area interaction by proactively participating in local events, supporting charitable causes, and providing financial education programs. By being Read More Here deeply ingrained in the neighborhoods they offer, cooperative credit union show an authentic commitment to boosting the health of their members and the neighborhoods in which they operate.

Via efforts such as volunteering, sponsoring community events, and supplying scholarships, cooperative credit union establish themselves as columns of support for neighborhood citizens. This energetic participation goes past simply giving financial solutions; it develops a sense of belonging and uniformity among participants. In addition, cooperative credit union usually work together with various other local organizations and companies to address community requirements properly. By cultivating these solid area connections, cooperative credit union not just improve their online reputation yet also add to the total development and prosperity of the areas they offer.

Personalized Financial Solutions

With a concentrate on fulfilling the one-of-a-kind economic requirements of their members, cooperative credit union supply customized economic services customized to specific scenarios and objectives. Unlike traditional financial institutions, cooperative credit union prioritize developing connections with their members to recognize their specific monetary situations. This customized approach permits lending institution to provide tailored remedies that align with participants' lasting objectives.

Lending institution provide a variety of customized monetary services, consisting of personalized economic examinations, tailored loan products, and personalized investment recommendations. By putting in the time to recognize each member's economic objectives, cooperative credit union can provide pertinent and targeted support to aid them attain economic success.

Furthermore, cooperative credit union typically provide customized budgeting aid and financial planning devices to aid participants handle their cash properly. These resources equip participants to make educated financial choices and work in the direction of their preferred financial end results.

Improved Customer Care

In the world of banks, the provision of remarkable client service collections lending institution besides other entities in the market. Lending institution are known for their commitment to putting go to website participants first, providing an extra tailored method to customer care compared to conventional financial institutions. One of the essential benefits of credit history unions is the enhanced level of customer service they supply. Members commonly have direct accessibility to decision-makers, allowing for quicker reactions to inquiries and a much more tailored experience.

Additionally, credit score unions typically have a strong emphasis on structure connections with their participants, intending to understand their unique monetary demands and goals. This tailored focus can lead to better economic suggestions and preferable product recommendations. Furthermore, lending institution staff are frequently praised for their kindness, readiness to Full Article aid, and general commitment to member fulfillment.

Conclusion

To conclude, cooperative credit union offer a series of advantages consisting of tailored customer support, lower costs, far better rates, and area participation. By prioritizing participant complete satisfaction and financial well-being, credit history unions concentrate on serving their participants' best rate of interests and aiding them accomplish their financial objectives efficiently. With a dedication to giving competitive rates and customized economic services, lending institution proceed to be a customer-focused and reliable choice for individuals looking for economic support.

By discovering the advantages of credit report unions further, one can uncover an economic organization that prioritizes its participants' financial health and aims to develop lasting partnerships based on trust and assistance.

Debt unions usually supply a variety of economic products and services, such as credit cards, home loans, and retired life accounts, all designed to meet the varied demands of their participants. - Credit Union Cheyenne

With an emphasis on meeting the one-of-a-kind economic requirements of their participants, credit report unions provide personalized financial services tailored to individual conditions and goals. By prioritizing member fulfillment and economic wellness, credit history unions concentrate on serving their members' best passions and assisting them attain their monetary objectives effectively.

Report this page